Phonepe Transaction Limit Per Day

Phonepe is currently one of the leading E-Commerce payment systems and digital wallets. It is founded in December 2015 and is now used by millions of people in the nation. The headquarter of the phonepe is located in the silicon valley of India that is Bangalore. The founder of the phonepe was Rahul Chari and Sameer Nigam. As we all know phonepe is the most used digital transaction application, and every second person is curious about the phonepe transaction limit per day. If you also want to learn about the phonepe transaction limit per day, you should check out the phone pay website to get more details. For now, let us tell you the phonepe transaction limit per day is Rs 1 lakh. So from now whenever you make any kind of transaction from phonepe make sure you would not exceed the phonepe transaction limit per day which is 100000.

Also Read: How to Earn 1000 Rs per Day without Investment Online- 2022

Details of PhonePe Transaction Limit:

The digital app phone was founded in 2015 but came into use in August 2016 along with the phonepe transaction limit per day. The app provides about 11 Indian regional languages, which makes people easily use and understand it. By using this digital payment method app with phonepe transaction limit per day the users can send and receive money for shopping bills, recharge DTH services, make utility payments, recharge mobile packs, pay water bills, pay for electricity, pay for data cards, and many more. Apart from this, users can also book cab rides, order food online, book hotel services, and pay for RedBus tickets, and flight tickets as well. About a million people are making online and offline transactions phonepe transaction limits per day by using the phone app, as they have covered the process of buying movie tickets, food items, travel, and so on.

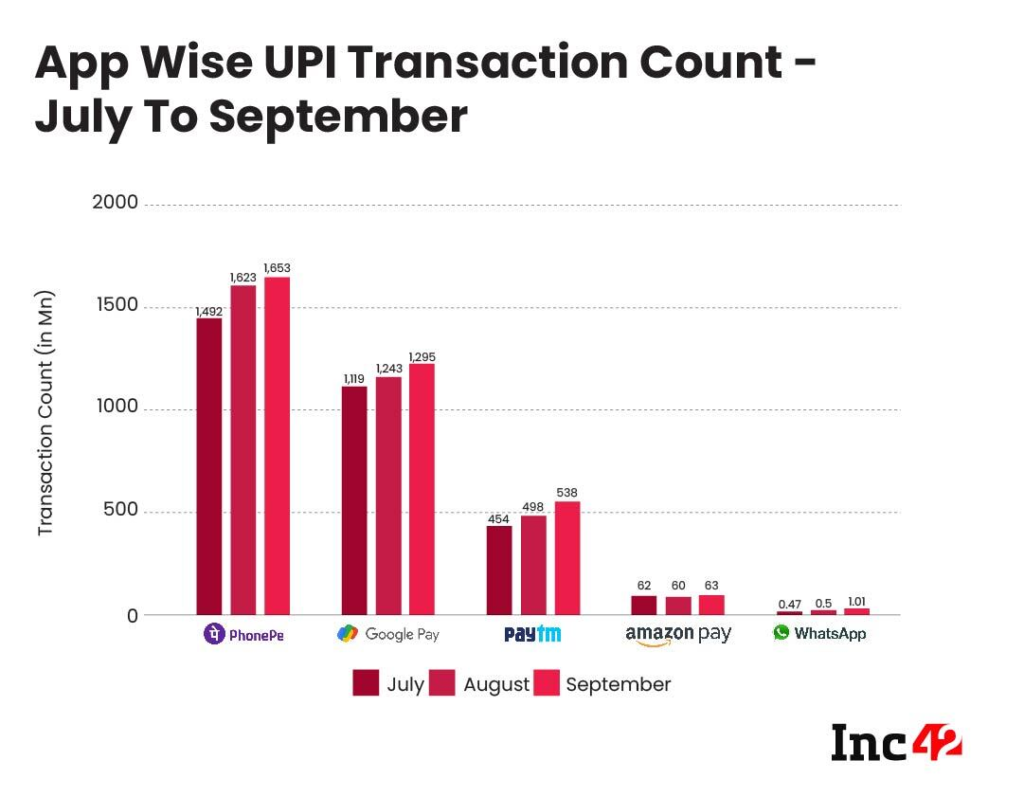

The phonepe transaction limit per day application is regulated by the RBI as they give license to the phonepe and any person in the nation can use it freely. The app works as a unified payment interface system, and the user has to provide the bank details that create the UPI ID. Users can download the phonepe app on Android phones and iPhones as well. You don’t have to recharge your wallet as you have to debit or credit money from your bank account just to use the phonepe.

Features of the phonepe transaction limit per day

- One application for upi

phonepe transaction limit per day is the one-stop for all the upi-based transactions. The users can have a bank account with any bank and pay to the multiple bank accounts of the user and one click. This single application eliminates all the bank applications to make digital transactions or online transactions.

- Split bills by using phonepe

If you are going out with your friends for a dinner trip or a movie and are worried about splitting their bill phone pay introduced the most amazing feature for you. All you have to do is to add all the friends in this split bill section, and phonepe will do the splitting work for you in the second.

- Pay charge and bills

You can use the phonepe transaction to pay your utility bills, recharge mobile numbers, and DTH. All you have to do is go to the recharge step and enter the required amount. Now choose the bank account and pay the same just by clicking on the button under the amount.

- Transparents send money by choosing the QR code

Phonepe provides the option to send and receive cash by using the QR code. The user just has to scan the code and everything is done by the QR code and so has to tap on the pay button.

Also Read: How to Open PPF Account in HDFC

Benefits of the phonepe

- This UPI-based application is very user-friendly and any person can easily learn to use it.

- The best part about this application is that it is available for all 365 days of the year. It is linked to the bank account, but it is provided with force each and every day of the year.

- It is very easy, safe, and secure to use the phonepe application.

- You will get instant cashback and a discount on the transactions.

- This application is available in many regional languages of India, which include Gujarati, Hindi, Tamil, Kannad, Marathi, etc.

- You don’t have to remember the details of the bank account like the IFSC code to make the transaction from one bank account to the other. Phonepe will then do everything for you, and you just have to approve it by clicking on the “pay or receive” button.

But to use the phonepe App, it is very mandatory for every person to complete the KYC process to avail of all the services provided by the phonepe. To send money, you also have to generate a collection request through the PhonePe app, but it is very essential to keep in mind that it is very much the same and you should not share your UPI pin with anyone. Every phone pay user can generate a safe, secure, and unique password for that transaction, and without it, you cannot initiate any transaction.

How to download and login to the phonepe?

- The very first thing you have to do is download the application from the Apple Store or Google Play Store. You don’t have to pay anything for it as it is freely available on the Play Store or Apple Store.

- Now you have to proceed to the post-downloading process of the application. Open the application and verify your registered mobile number, which is linked to your bank account.

- Now you should fill in all the required details, which include your name, email address, and the four-digit password to activate your e-wallet.

- After completing all the above procedures, you have to create a new virtual private address.

- Select your bank account and link it with the same phonepe app. The phone application will automatically fetch all the provided details from your bank.

- Don’t forget to cross-check and confirm all the details provided by the bank on the application.

Also Read: PPF ACCOUNTS

The procedure to add the bank account to the phonepe

- In the first step, you have to open the menu by tapping on the phone pe application, which is provided on the right top icon of the corner screen.

- Now you should go to the bank account section and tab on “Add New Bank Account.”

- Now select the respective bank which you want to link with the phone pe application from all the bank places available there.

- To proceed with the phonepe application will automatically set up all the account details, and your bank account will be linked to the e-wallet application.

- In this section, you have to set your UPI pin by selecting the “set upi pin” option provided there.

- Enter all your card details like the 6 digits of your debit card or ATM card number and the expiry date as well.

- Enter the OTP and set the UPI pin.

- Now your bank account details will be added successfully, and you can directly transfer the amount by using the UPI pin.

FAQ:

Q. When was PhonePe founded?

Ans. Phonepe was founded on 2015

Q. From when phonepe was live in the market for use?

Ans. In 2016, it was livein the market for use

Q. What is the phonepe transaction limit per day?

Ans. The phonepe transaction limit per day is Rs 1,00,000

More Articles: 8 Difference between Current Account and Savings Account

Bank of Baroda Fixed Deposit Rates- 2022

Top 10 Startup Companies in Hyderabad

Mutual Funds Are Subject To Market Risk

Punjab National Bank PPF Account, Interest Rate- 2022-23

Which Bank Is Best For Demat Account

Hello there, my name is Phulutu, and I am the Head Content Developer at Nivesh Karlo. I have 13 years of experience working in fintech companies. I have worked as a freelance writer. I love writing about personal finance, investments, mutual funds, and stocks. All the articles I write are based on thorough research and analysis. However, it is highly recommended to note that neither Nivesh Karlo nor I recommend any investment without proper research, and to read all the documents carefully.

Leave a Reply