One of the most well-known Insurance Plans offered by Life Insurance Corporation of India, the sole public sector insurer, is Jeevan Anand (Plan 149) by a wide margin. It makes calculations so easy as they provide a separate jeevan anand (plan-149) maturity calculator for the users. There is no longer a way to purchase this plan because it has already been taken off the market.

Read Also: How to change nominee in LIC

Principal Elements of jeevan anand (plan-149) bonus

- Endowment Assurance and Whole Life Insurance are both included in the Jeevan Anand plan.

- After the term has ended, the maturity benefit, which consists of the sum assured plus accrued (simple reversionary) bonuses and final addition bonuses (if any), will become available.

- Insurance coverage in the amount of the Sum Assured is available for as long as you live, or until you turn 100 years old, whichever comes first.

- Death benefits during the policy’s term will include the sum assured plus accrued bonuses.

- This plan’s built-in benefits, which include a double accident benefit and an extended permanent disability benefit, are available throughout the plan’s term and also until the age of 70. The most that DAB & EPDB will cover is Rs. 5 lakhs.

- The Critical Illness Rider, which is optional, offers coverage for particular critical illnesses.

Plan 149 of LIC Jeevan Anand’s eligibility requirements and limitations

| LIC Jeevan Anand 149 – Conditions and restrictions | ||

| Condition | Minimum | Maximum |

| Age at entry | 18 years | 65 Years |

| Premium Paying Term | 5 Years | 57 Years |

| Sum Assured | 1,00,000 | No Limit |

| Sum Assured Rebate | ||

| Sum Assured | Rebate | |

| Up to 2.95 lakh | Nil | |

| 3 lakh to 4.95 lakh | Rs. 1 per 1000 Sum assured | |

| 5 lakh to 9.95 lakh | Rs. 1.50 per 1000 Sum assured | |

| 10 lakh and above | Rs. 1.75 per 1000 Sum assured | |

| Mode Rebate | ||

| Yearly mode | 3% of tabular premium | |

| Half-yearly mode | 1.5% of tabular premium | |

| Quarterly, Monthly and SSS | NIL |

Benefits of the Maturity Plan for jeevan anand (plan-149) bonus

The maturity benefit of the plan will be paid following the expiration of the premium payment term. It is improper to conflate the term and the term that pays a premium. The term of the Plan shall be from and after the Date of Effectiveness until the Age of One Hundred. However, the policyholder chooses the duration of the premium-paying term (between 5 and 57 years).

The maturity benefit will be calculated by adding the Sum Assured, Accrued Bonus, and Final Additional Bonus (in accordance with the declared amount at the year of maturity).

Bonus rates for the LIC Jeevan Anand 149 Plan as of right now

The plan includes two distinct bonus types. One of these is the yearly simple reversionary bonus, which is credited to the policy account immediately after it is announced. The Final Additional Bonus, a one-time payment made at the time the policy is terminated due to maturity or death, is the second.

Annual announcement of a straightforward reversionary bonus

The most recent Simple Reversionary Bonus Rates for the Plan (per 1000 Sum Assured) are shown in the table below.

| Jeevan Anand – 149 Bonus Rates (per 1000 Sum Assured) | |||

| Term | Bonus Rate 2016 Valuation | Bonus Rate 2016 Valuation | Bonus Rate 2016 Valuation |

| < 11 Years | 38 | 38 | 38 |

| 11 to 15 Years | 41 | 41 | 41 |

| 16 to 20 Year | 45 | 45 | 45 |

| > 20 years | 49 | 49 | 49 |

One-time bonus paid upon exit through maturity or death.

Following are the final additional bonus rates that apply to the Jeevan Anand plan. When determining maturity, the policy’s term is taken into account; however, when determining death cases, the time until death is taken into account.

| Final Additional Bonus Rate – Jeevan Anand 149 | ||

| Term for Maturities / Premium paid period for death claims | FAB rate per 1000 SA | |

| Below 2,00,000 | 2,00,000 and above | |

| Below 15 | 0 | 0 |

| 15 | 10 | 20 |

| 16 | 20 | 35 |

| 17 | 35 | 50 |

| 18 | 50 | 75 |

| 19 | 75 | 100 |

jeevan anand (plan-149) maturity calculator Benefits

The jeevan anand (plan-149) bonus, Benefit and Maturity Calculator is an online tool that makes it simple to understand all of the plan’s benefits. You can get all the information you need from this Best told jeevan anand calculator, including your current payment, the pattern of your insurance coverage, maturity benefits, etc. You can enter your own information, such as Age, Sum Assured, Term, etc., to get a table-formatted summary of the entire plan.

If the premium and benefit old jeevan anand calculator please check to open the jeevan anand (plan-149) maturity calculator – Premium, Benefit and Maturity Calculator.

Death benefits under plan 149

Two distinct death insurance options are provided by jeevan anand (plan-149) bonus.

- In the event of death during the term for which premiums are being paid, the death benefit will include the Sum Assured plus any accrued bonuses.

- Death coverage after the premium-paying term: Jeevan Anand’s special additional risk coverage offered after the term of paying premiums provided a sum assured equal to the plan’s assured amount.

Internal Rate of Returns – jeevan anand (plan-149) bonus: What Is It?

Calculating an insurance plan’s internal rate of return (IRR) with jeevan anand (plan-149) maturity calculator is the best way to determine the interest rate it offers. Since Jeevan Anand is an insurance product, there will unavoidably be a loading when disbursing insurance benefits. Remove this loading before calculating the rate of return if you want to compare this plan to other savings plans.

Additionally, this plan will be subject to an additional lifelong insurance coverage. Let’s think about three scenarios to better understand this benefit.

- Death occurs during the term of payment of premiums

- immediate death following maturity

- 80 years old when they passed away.

What is the LIC Jeevan Anand Plan’s Mechanism?

When purchasing the policy, the policyholder selects the plan’s duration and insured amount. The premium is established based on the age of the insured, the amount insured, and the term of the selected policy. For as long as the policy is in effect, the policyholder is required to pay premiums.

The policyholder will receive a maturity benefit if the insured person lives to the end of the insurance period and all premiums have been paid.

The amount due at maturity is equal to:

Guaranteed sum plus all premiums collected during the policy’s term and any extra payments.

The nominee now also receives the sum insured as a death benefit at each death of the policyholder (including those that occur after the contract has expired).

However, if the insured passes away during the policy’s term, the death benefit is given to the designated beneficiary in the following manner: sum of the insurance coverage at death plus any bonuses accrued up to the time of death plus any bonuses.

The amount insured in the event of death equals at least 105% of the total premiums paid up to the time of death, 125% of the guaranteed basic sum, or ten times the annual premiums.

Also Read: Why should we choose Kotak guaranteed savings plan?

The Tax Effects of Jeevan Anand 149

As with other endowment-type plans, the Jeevan Anand plan adheres to the E-E-E (Exempt-Exempt-Exempt) taxation pattern.

- According to Section 80C of the Income Tax Act, Premium Paid is Exempt from Income Tax.

- According to Section 10(10D) of the Income Tax Act, the maturity amount is not taxable.

- According to Section 10(10D), death insurance, including life insurance, will be tax-free.

Read Also: 20 Best Tax saving schemes Under 80C-2023

Value of Jeevan Anand Plan 149’s surrender

Any time, including during the term for which premiums are due, this policy may be canceled.Let’s take a closer look.

surrendering while the premium is being paid

After the Jeevan Anand plan has accrued paid-up value, it can be surrendered at any time for a lower cash value. Three years must pass from the commencement date and three full years of premium must be paid in order to acquire paid up value.

Nothing will become payable for any policies for which the premium hasn’t been paid in at least three years.

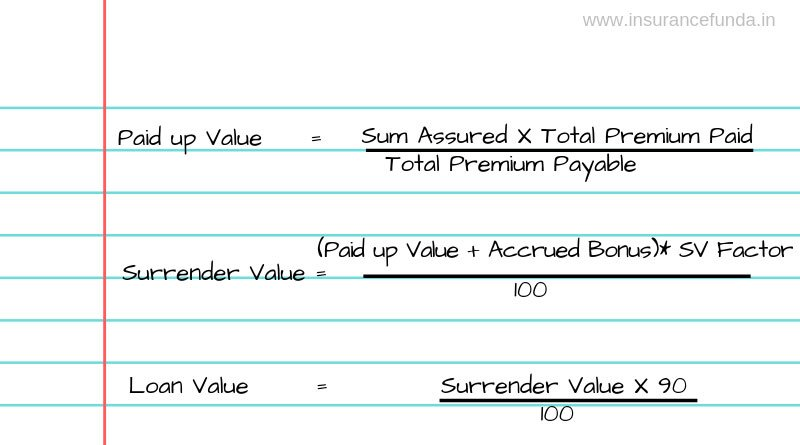

The formulas that are used to determine the surrender value of any endowment-type plan are as follows.

If you are considering abandoning the plan, I would advise you to think about the following before making a choice.

- Because the policy was started several years ago, you are losing valuable insurance coverage that was also purchased at a lower premium.

- When a Jeevan Labh plan is surrendered, a loss may result because the surrender value may be lower, particularly if the premium payment period was shorter.

- The best course of action if your policy has expired and you are unable to reinstate it is to keep it paid up and receive the maturity benefit at the conclusion of the term. Your insurance coverage will be based on the paid-up value, and at policy maturity, you can take advantage of the full accrued bonus as well as the paid-up value of the policy.

Also Read: How to earn money online without investment in mobile

Jeevan Anand’s “Life Long Coverage” has been given up 149

Jeevan Anand continues to provide free lifetime insurance coverage even after receiving the maturity sum. Although giving up lifelong insurance coverage is not recommended, LIC offers the option to do so and receive the cash value of the policy.

Benefits of the jeevan anand (plan-149) maturity calculator

You can calculate maturity dates, retirement benefits, death benefits, surrender values, guaranteed present values, loan values, etc. with the highest bonus paid by using the jeevan anand (plan-149) maturity calculator.

The best course of action is this one.

So, before buying a Jeevan Anand policy, make sure the maturity amount is equal to the desired sum insured.

Utilize jeevan anand (plan-149) maturity calculator to determine maturities based on insured sum, age, and other factors. Additionally, the value can be determined at maturity using the jeevan anand (plan-149) maturity calculator.

The Best told jeevan anand calculator Returns can also be used to determine the return value.

FAQ

1. How is the PFR’s duration determined?

Ans. Typically, the term is 200% of what you pay over 20 years, and about 250% over 25 years. Typically, the insured base sum (sum insured) and cumulative bonus added annually make up the value at maturity. Survivor benefits for reimbursement insurance are distributed every four to five years.

2. What Is the Jeevan Anand Plan 149’s Maturity?

Ans. Considering that the policyholder’s chosen payment period (between 5 and 57 years) applies to the premium payment period. According to the amount specified in the due date, the Maturity Benefit is the total of the insured amount, cumulative bonus, and most recent additional bonus.

3. How do you determine the amount due at maturity?

Ans. The maturity value is calculated using the formula V = P x (1 + r) n. You’ll see that the formula includes the variables V, P, r, and n. P represents the initial principal amount, n represents the number of capitalization intervals between the date of issue and the maturity date, and V represents the value at maturity. This recurring interest rate is represented by the variable.

More articles: 10 Best Guaranteed Income Plans 2023 in India

Student loan calculator: A Complete Guide

How to invest in startups in India

How to start sip: A Complete Guide

How To Deposit Money In SBI ATM Along With The Other Features Of ATM

Hello there, my name is Phulutu, and I am the Head Content Developer at Nivesh Karlo. I have 13 years of experience working in fintech companies. I have worked as a freelance writer. I love writing about personal finance, investments, mutual funds, and stocks. All the articles I write are based on thorough research and analysis. However, it is highly recommended to note that neither Nivesh Karlo nor I recommend any investment without proper research, and to read all the documents carefully.

Leave a Reply