A cheque is a negotiable instrument that instructs the bank to withdraw a certain amount from the drawer’s bank account and pay it to the person to whom it is issued, to the person to whose order it is issued, or to the bearer of the cheque. A cheque is written to three parties:

| Drawer | The person who signs the cheque or instructs the bank to pay a specific amount through a cheque is known as the drawer of the cheque. |

| Drawee | The bank that has been instructed to pay the amount specified on the cheque is referred to as the drawee of the cheque. |

| Payee | The individual to whom the bank is required to deliver the funds is referred to as the payee. |

There are many different types of cheques, including crossed, stale, open, self-made, bank, and cancelled cheques.

In this content, you will get to know about how to cancel a cheque, what are the uses of cancelled cheque and a lot many more.

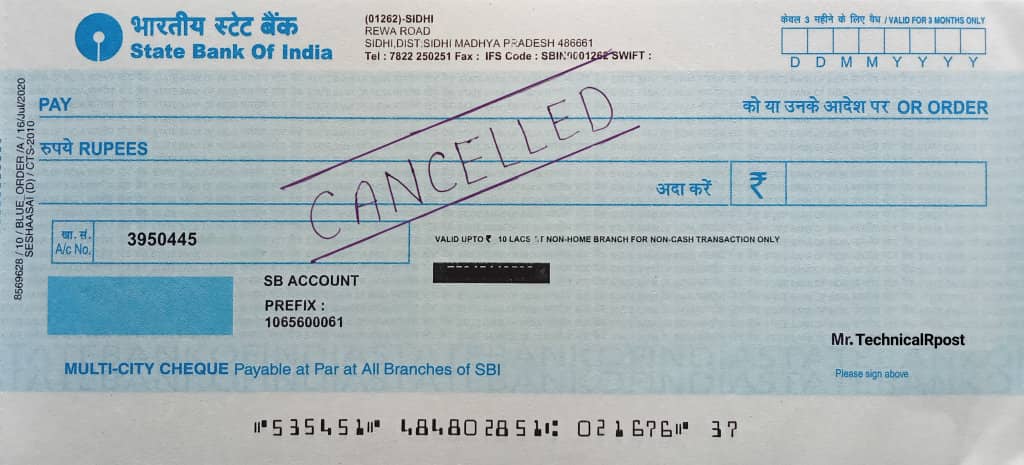

A Cancelled Cheque Example

A cancelled cheque is one that has the word “cancelled” written across it and is crossed with two lines. There is no requirement for anything else to be written on a cheque besides the word “cancelled.” A cheque may be cancelled if any mistakes were made while writing it, which is why it is known as a cancelled cheque. Usually, it is cancelled to prevent the cheque from being used improperly by anyone.

However, a voided cheque serves as evidence that the person has a bank account. Even though a cancelled cheque cannot be used to withdraw money from the drawer’s account, it still contains other information, including the name of the account holder, the account number, the MICR code, the IFSC code, the name and branch of the address where the account is located, and the cheque number.

Also Read: Application For Reopen Bank Account

Uses Of A Cancelled Cheque

Although a voided cheque cannot be used to obtain cash, there are several other uses for it. Among the uses of a cancelled cheque are a few of the following:

- The information on cancelled cheques, which includes the individual’s name, account number, and the name and branch address of the bank where they have an account, is useful for Know Your Customer (KYC) procedures when investing in mutual funds or the stock market.

- EQUAL MONTHLY INSTALLMENTS (EMI) – EMI options are available for a variety of loans, including home loans, student loans, car loans, and others. In order to complete the necessary paperwork to assign such monthly payment methods, the bank or company in question would need a cancelled cheque.

- A cancelled cheque, a form for opening an account, and additional KYC documents, such as a proof of identity or proof of address, must be provided to the stock brokerage in order to open a demat account. Individuals can store their shares electronically in a demat account.

- ECS (ELECTRONIC CLEARANCE SERVICE) – ECS is an electronic method for transferring money between bank accounts. A cancelled cheque from you would be needed by the bank for this deduction if you set up an ECS from your account, which would result in a monthly withdrawal of funds.

- EMPLOYEE PROVIDENT FUND (EPF) WITHDRAWAL: In order to verify the account information of the person making the withdrawal, a cancelled cheque must be provided.

- Opening a bank account requires the submission of a cancelled cheque in order for the procedure to be completed.

- INSURANCE POLICIES – Some businesses request a cancelled cheque from a potential policyholder when they choose an insurance policy.

How to Write a Cancelled Cheque – cancelled cheque format

It’s crucial to cancel a cheque because they can otherwise be easily misused. The steps listed below should be followed if you are canceling a cheque to submit it for a specific reason:

Take a new cheque out of the leaf containing the one you want to cancel

Step 1. Do not sign the cheque anywhere.

Step 2. Cross two parallel lines across the cheque in step two.

Step 3: Capitalize the word “CANCELLED” between those two lines.

It’s important to note that the parallel lines you drew across the cheque leave out a number of crucial information, including the account number, name of the account holder, IFSC code, MIRC code, name and branch address of the bank where the account is held, etc.

If you want to cancel a cheque due to a mistake you may have made, you can do so by starting at step 2 of the procedure described above.

A cancelled cheque can still be used for many fraudulent activities even though it cannot be cashed. To be on the safe side, when you give someone a cancelled cheque, make sure that you don’t sign it and that you give it to the right person who will be collecting it.

Also Read: Bank of Baroda Fixed Deposit Rates- 2023

When is a Cancelled Cheque Required?

There are several situations where a cancelled cheque is necessary, as detailed below:

- The most crucial document to provide for KYC completion when investing in the stock market, mutual funds, or other related financial schemes is a cancelled cheque.

- It is necessary to provide a cancelled cheque when withdrawing funds from your EPF account.

- With the electronic clearance service, it is possible to transfer money between accounts. You must provide your bank with a cancelled cheque in order to activate this feature on your account.

- Before finalising your EMI payments against an acquired loan or credit amount, your bank or NBFC will request a cancelled cheque for your account.

- You must submit a cancelled cheque along with other KYC documents, such as identification and residency proof, in order to open a Demat account.

- For Insurance– When you purchase an insurance policy, you will be required to provide a cancelled cheque to identify your bank account.

Cancelled Cheque FAQs:

1. How do I return a cheque?

A simple way to cancel a cheque is to cross it with two lines and write the word “CANCELLED” in capital letters between the two lines.

2. In which circumstances are cancelled cheques necessary?

Cancelled cheques come in handy on a number of occasions when they are required as part of processes like KYC, EMI, ECS, when choosing an insurance policy, when opening a Demat account, when withdrawing PF, and when opening bank accounts.

3. If I ask them to, will my bank cancel a cheque?

If you don’t have a cheque leaf for your bank account, the bank will give you one; you can choose a new cheque and cancel the old one if necessary. However, the bank cannot cancel your cheque.

4. Do I need to sign a voided cheque?

A cancelled cheque should not have your signature on it because it could be misused. There is no requirement that you submit a signed, cancelled cheque.

5. What are the dangers of cancelling a cheque?

Although returning a cancelled cheque is not risky, it could be used fraudulently because it contains information about your account, including your account number, IFSC code, bank name and branch address, MICR code, etc.

Also Read: 8 Difference between Current Account and Savings Account

Punjab National Bank PPF Account, Interest Rate- 2023

India Post Payment Bank Account Opening Online

How to Open PPF Account in HDFC

Hello there, my name is Phulutu, and I am the Head Content Developer at Nivesh Karlo. I have 13 years of experience working in fintech companies. I have worked as a freelance writer. I love writing about personal finance, investments, mutual funds, and stocks. All the articles I write are based on thorough research and analysis. However, it is highly recommended to note that neither Nivesh Karlo nor I recommend any investment without proper research, and to read all the documents carefully.

Leave a Reply