Paytm Full Form

We are all aware of the popularity and usage of pay through mobile, Paytm full form. It is an RBI-approved and secure digital mobile wallet and is used to meet almost every kind of financial need. You can add money to your payment through mobile, Paytm, using methods such as internet banking, credit cards, and debit card UPI. You can also send money from your pay through mobile, Paytm to your bank account or any other person’s Paytm wallet without any kind of charge. Paytm full form is Paythrough Mobile, and it is one of the most widely used digital transaction-making applications.

Pay through mobile, Paytm full form, and use it to perform the following transactions:

- Pay through mobile is used to pay utility bills like electricity, broadband, landline, municipal taxes, water, gas, etc. From this, you can also busy education bills suggest school fees, and the apartment run by using the pay-through mobile.

- By using Paytm you can recharge your mobile phone, broadband connection, DTH, Google Play services, metro card, etc. Pay your paid bills credit card bills through Paytm.

- Now it is very easy to book flight tickets, train tickets, bus tickets, movie tickets, etc. You can book directly through the Paytm application using the Paytm payment mode for applications like IRCTC BookMyShow etc.

- You can avail of the other partner applications by using the Paytm wallet to pay, such as Flipkart, Zomato, Uber, Ola, etc. You can also go directly to the third-party apps and use the Paytm account to pay for online transactions.

Also Read; How To Save Money From Salary

- Pay through mobile, the mobile app also has the feature of Paytm Mall which allows you to do online shopping from the famous E-Commerce platform slide Myntra Flipkart, Jio, Amazon, etc. You cannot only use pay through mobile, Paytm for third-party applications but also check out the office and vouchers by using your Paytm to get the extra cashback and discount

- Pay through mobile provides you with the chance to buy and share gift vouchers with your friends or purchase subscriptions to their live streaming platforms.

- You can also order food medicine, consult with doctors, and various lifestyle accessories by visiting Pay through mobile.

Features of the Pay through mobile, (Paytm)

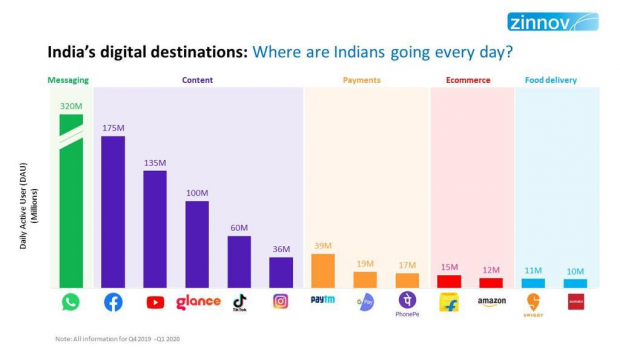

Paytm is one of the largest payment platforms in India and it allows its users to transfer money to another by using the Paytm wallet without any extra charges. It also helps users book movie tickets available from other applications. Here are some attractive features of the Paytm wallet which every person should know about.

- Pay through mobile, (Paytm) is a digital application that is governed by the RBI as it is safe, secure, and approved.

- The money present in your Paytm wallet is like ready-to-use cash as you can access it anytime, anywhere, and at any place with the help of an internet connection.

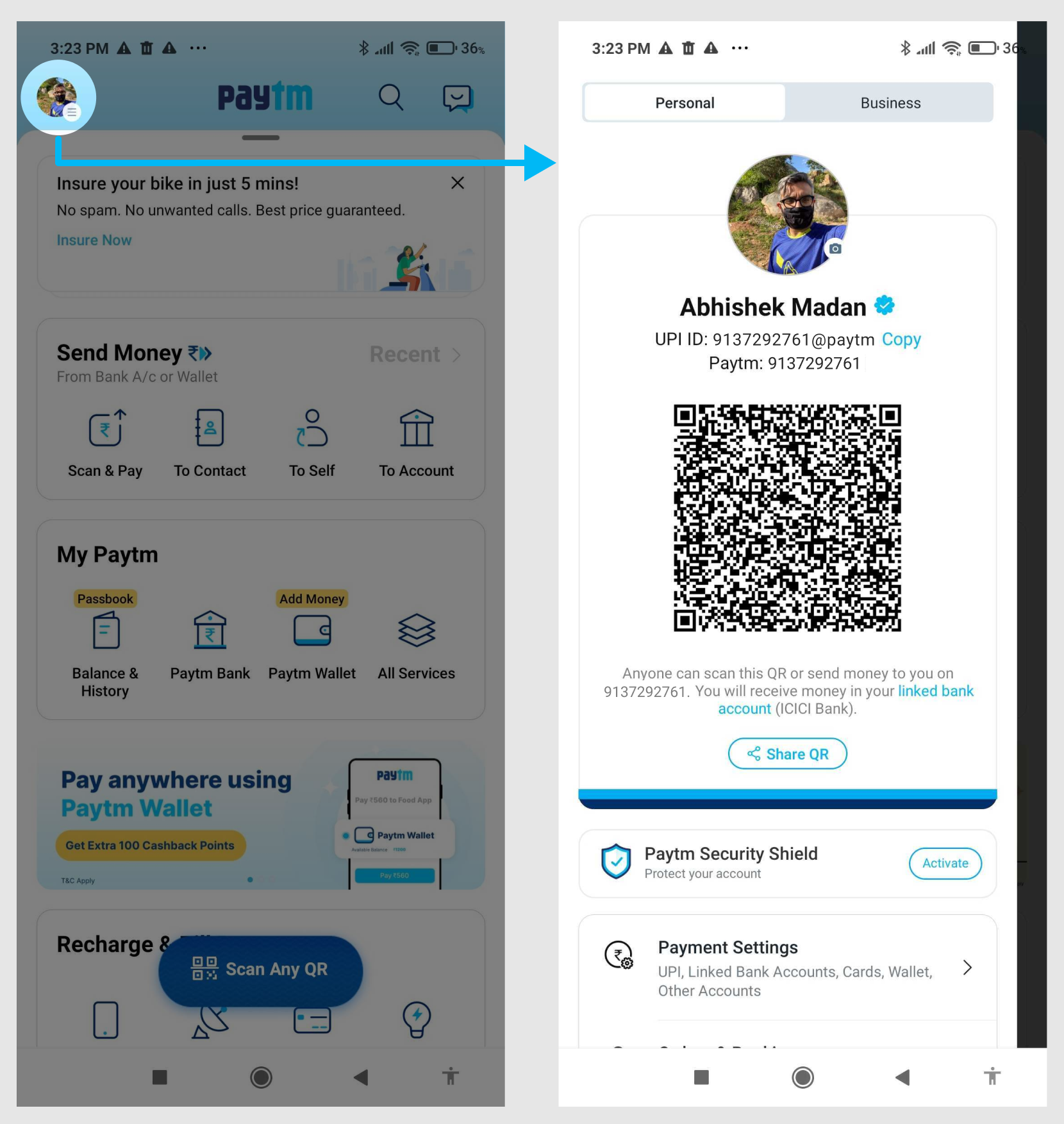

- You can add money to your Paytm wallet just by using a debit card, credit card net banking, or the UPI method.

- Let us tell you that your verification will be 1 lakh rupees in a month just after completing the KYC through a simple and quick process. To complete the Paytm KYC, one only needs to submit a passport, driving license, or voter ID card to activate the Paytm wallet.

- After completing the KYC verification, you can either go with the video KYC and do the KYC from your comfort zone or visit the nearest KYC store to upgrade the monthly limit.

What are the benefits of using pay through mobile, (Paytm full form)?

If you check out the advantages of the Paytm wallet, then there are numerals you can’t count on your hands. Paytm changed the method of online transactions as it makes them easier and faster. The below points will help you to understand the benefits of the Paytm wallet to a common person.

- Pay through mobile, (Paytm) helps the person to make cashless and digital transactions. It is safer to pay without including the bank in your transactions full stop the Paytm application is governed and strictly regulated by the RBI guidelines.

- We all know that the payments made by the Paytm wallet are conveniently quick and simple for every user. The interface of the application is very easy and any person can understand it in no time.

Also Read; Bank account closing letter format and how to write it.

- The most lucrative point of Paytm is that it provides 100 reward discount scratch cards and offers cashback for the benefit of the users in the long run.

- Pay through mobile, (Paytm full form) is the only application that ensures you get an easy refund from the other partner application if you cancel or return the order for any issue with the partner store. It is done by Paytm if you use Paytm to make the transaction.

- You can avail the facility of Paytm postpaid if you have a good credit score. Paytm can offer you credit of up to 60,000 without requiring any kind of documentation or legal procedure.

- Be recommend you link your Paytm account with the Fastrack account so that it may make travel easier for you through the toll plazas across your country. With Paytm, you don’t have to recharge faster every now and then because you can simply add money to your Paytm wallet. The amount will be directly detected from your Paytm wallet when you cross any toll plaza in your country.

- The other attractive point of Paytm is that it accepts all QR code payment gateways. You can also use the Paytm QR code scanner to scan the QR code of any other application to make digital transactions.

Also Read; Why should we choose Kotak guaranteed savings plan?

- You can also minimize your efforts by setting up your Paytm with the automatic add money feature. It means the Paytm wallet will automatically withdraw the money that you selected earlier if it goes below a certain amount fixed by you.

- The Paytm wallet will also send you kind reminders so that you will not forget any kind of medication payments or baby late charges.

- Paytm also provides you with the spend analytics feature, which helps you to track your regular expenses and the money you have been spending so far in the month. It will help you plan your monthly budget and future expenses as well.

- Just like the bank account, you can also request your Paytm wallet to send money to the other bank accounts or receive from them without any kind of charges.

- Paytm provides you with a 24/7 helpline number along with the chart booth option. You can use anyone according to your convenience as well. The customer care number for Paytm is 0120 4456456. You can use this number for any kind of query related to your bank account.

- You can set a security password on your Paytm wallet so that the chances of making mistakes will get lower and you can make transactions safely.

FAQs on Paytm (Paytm full form):

Q. What is the Paytm full form?

Ans. Paytm full from is Pay through mobile

Q. What is the maximum transaction amount paid by Paytm?

Ans. Rs 1 lakh is the maximum amount you can pay.

Q. How much credit does Paytm provide?

Ans. Paytm provides Rs 60,000 credit

More Articles: India Post Payment Bank Account Opening Online

5 Best Steps of the Investment Process

Bank of Baroda Fixed Deposit Rates- 2022

Hello there, my name is Phulutu, and I am the Head Content Developer at Nivesh Karlo. I have 13 years of experience working in fintech companies. I have worked as a freelance writer. I love writing about personal finance, investments, mutual funds, and stocks. All the articles I write are based on thorough research and analysis. However, it is highly recommended to note that neither Nivesh Karlo nor I recommend any investment without proper research, and to read all the documents carefully.

Leave a Reply